The Best Student Loans Options for 2021

Hey there, all you smart students out there! If you’re looking for the best student loan options for 2021, you’ve come to the right place. With the rising cost of education, finding the right loan can be a game-changer in your academic journey. Whether you’re a first-time borrower or thinking about refinancing, we’ve got you covered with the latest information and tips to make the best choice for your future. Let’s dive in and explore the top student loan options for 2021!

Understanding the Importance of Credit Scores for Student Loans

When it comes to applying for student loans, one of the key factors that lenders consider is your credit score. Your credit score is a numerical representation of your creditworthiness, which is based on your credit history and financial behavior. In simple terms, it tells lenders how likely you are to repay the loan on time.

Your credit score can have a significant impact on your ability to qualify for student loans and the terms you are offered. A higher credit score typically means that you are seen as a lower risk borrower, making you more likely to be approved for a loan with lower interest rates and better terms. On the other hand, a lower credit score can make it harder to qualify for loans and may result in higher interest rates or the need for a cosigner.

One of the main reasons why credit scores are so important for student loans is because most students have limited credit history. If you have never taken out a loan or credit card before, you may not have a credit score at all. In this case, lenders have no way to assess your creditworthiness, which could make it difficult to qualify for student loans.

On the other hand, if you do have a credit score, lenders will use this information to determine your risk level as a borrower. They will look at factors such as your payment history, credit utilization, length of credit history, and types of credit accounts to calculate your credit score. The higher your score, the more likely you are to be approved for student loans with favorable terms.

It’s important to note that not all student loans require a credit check, but those that do will typically have better terms for borrowers with higher credit scores. Private student loans, for example, often require a credit check and may have variable interest rates based on the borrower’s creditworthiness. Federal student loans, on the other hand, do not require a credit check and are available to all eligible students regardless of their credit score.

In conclusion, your credit score plays a major role in determining your eligibility for student loans and the terms you are offered. It is important to understand how credit scores work and to take steps to build and maintain a good credit history. By doing so, you can improve your chances of qualifying for student loans with favorable terms and avoid the need for a cosigner.

Comparing Interest Rates and Terms of Different Lenders for Student Loans

When it comes to student loans, one of the most important factors to consider is the interest rate. This is the rate at which the lender will charge you for borrowing the money. It’s crucial to compare the interest rates offered by different lenders to ensure you’re getting the best deal possible.

Some lenders offer fixed interest rates, which means the rate will stay the same throughout the life of the loan. This can provide stability and predictability in your monthly payments. On the other hand, some lenders offer variable interest rates, which can change over time based on market conditions. While variable rates may start lower than fixed rates, they can potentially increase in the future, leading to higher payments.

In addition to interest rates, it’s essential to consider the terms of the loan. This includes the length of the repayment period, any grace periods, and whether there are any fees associated with the loan. Longer repayment periods may result in lower monthly payments, but you could end up paying more in interest over time. On the other hand, shorter repayment periods may lead to higher monthly payments but can save you money on interest.

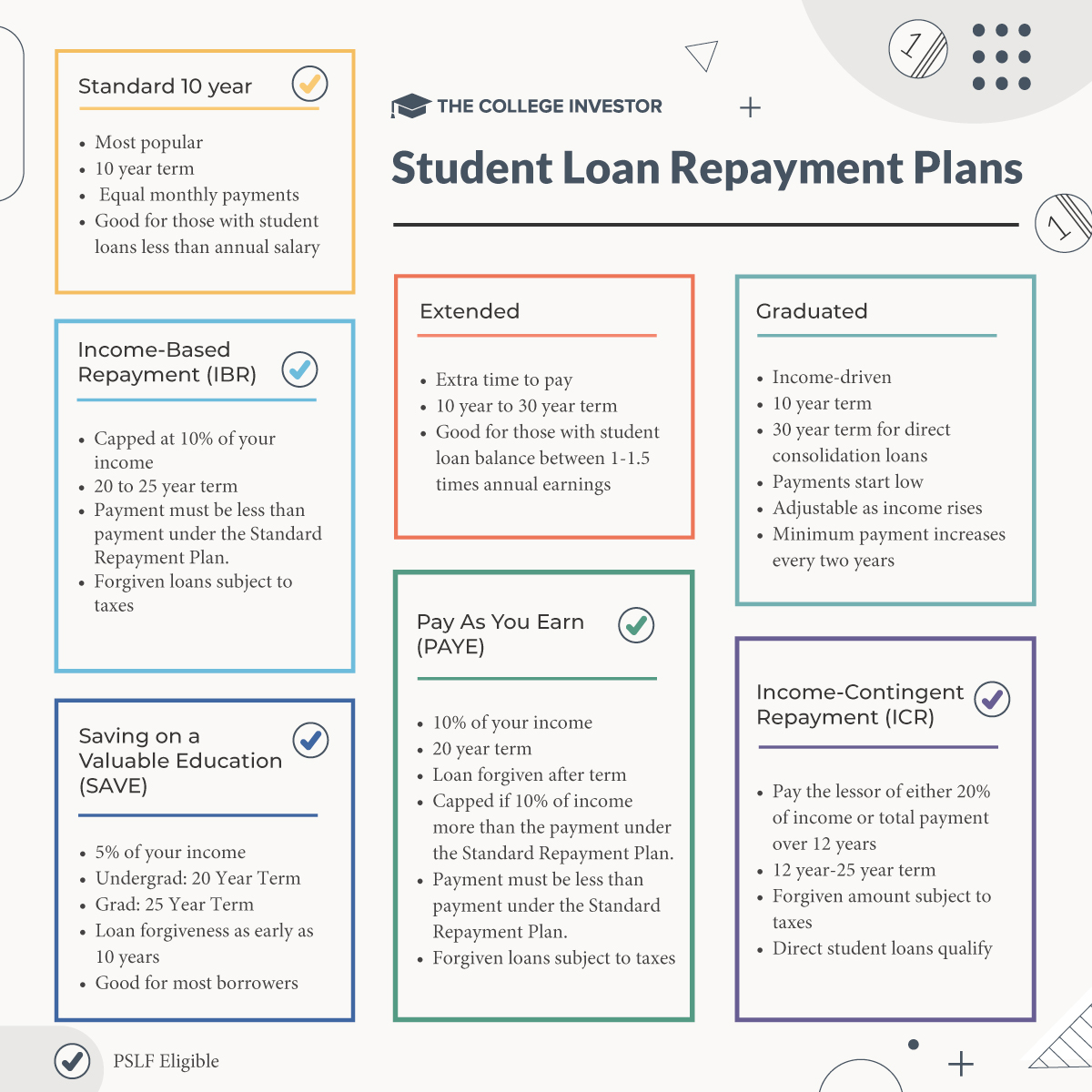

Another factor to consider is whether the lender offers any flexibility in repayment options. Some lenders offer income-driven repayment plans, which adjust your monthly payments based on your income level. This can be beneficial if you anticipate having difficulty making payments after graduation.

When comparing interest rates and terms of different lenders, it’s essential to do your research and shop around. Look at online reviews and customer feedback to get a sense of the lender’s reputation. Make sure to read the fine print and understand all the terms and conditions of the loan before signing on the dotted line.

Ultimately, choosing the right student loan lender can make a significant difference in your financial future. By comparing interest rates and terms of different lenders, you can make an informed decision that aligns with your financial goals and needs.

Exploring the Best Options for Federal Student Loans

When it comes to financing your education, federal student loans are often a popular choice for many students. These loans are backed by the government and offer a range of benefits such as fixed interest rates, flexible repayment plans, and loan forgiveness options. Here, we will explore some of the best options for federal student loans that can help you achieve your educational goals without breaking the bank.

1. Direct Subsidized Loans: Direct Subsidized Loans are available to undergraduate students who demonstrate financial need. The government pays the interest on these loans while you are in school at least half-time, during the six-month grace period after you leave school, and during any periods of deferment. This can help lower the overall cost of your loan and make repayment more manageable.

2. Direct Unsubsidized Loans: Direct Unsubsidized Loans are available to both undergraduate and graduate students, regardless of financial need. Unlike subsidized loans, you are responsible for paying the interest on these loans from the time the loan is disbursed until it is paid in full. However, these loans still offer competitive interest rates and flexible repayment options.

3. Direct PLUS Loans: Direct PLUS Loans are available to graduate students and parents of dependent undergraduate students. These loans can cover up to the full cost of attendance, minus any other financial aid received. While these loans typically have higher interest rates compared to other federal student loans, they can still be a valuable option for those who need additional funding to cover their educational expenses.

Direct PLUS Loans also offer flexible repayment options, including income-driven repayment plans and loan forgiveness programs. Additionally, these loans do not have stringent credit requirements, making them accessible to a wider range of borrowers.

Overall, federal student loans offer a reliable and affordable way to finance your education. By exploring the best options for federal student loans, you can make informed decisions about your borrowing and set yourself up for financial success in the future.

Tips for Securing Private Student Loans with the Lowest Rates

When it comes to securing private student loans with the lowest rates, there are several tips and strategies that students can consider. In this section, we will discuss four key tips that can help you secure the best possible rates for your student loans.

1. Maintain a Good Credit Score: One of the most important factors that lenders consider when determining the interest rate for your student loan is your credit score. A higher credit score generally translates to lower interest rates, so it’s important to maintain a good credit score by making timely payments on existing debts and avoiding taking on too much debt.

2. Shop Around: Just like with any other financial product, it’s important to shop around and compare offers from multiple lenders before committing to a private student loan. Different lenders may offer different interest rates and terms, so taking the time to compare offers can help you find the best deal.

3. Consider a Co-Signer: If you have a limited credit history or a lower credit score, you may want to consider applying for a private student loan with a co-signer. A co-signer with a strong credit history can help you secure a lower interest rate on your loan, as lenders will take their creditworthiness into account when determining the terms of the loan.

4. Take Advantage of Discounts and Incentives: Some lenders offer discounts or incentives to borrowers that can help lower the overall cost of the loan. For example, some lenders may offer an interest rate reduction for setting up automatic payments, while others may offer a loyalty discount for borrowers who have a existing relationship with the bank. Be sure to ask about any discounts or incentives that may be available to you when exploring your loan options.

By following these tips and strategies, you can increase your chances of securing a private student loan with the lowest rates possible. Remember to do your research, compare offers, and consider all of your options before committing to a loan, as this can help you save money in the long run.

Maximizing Scholarship and Grant Opportunities to Minimize Student Loan Debt

One of the most effective ways to minimize student loan debt is to maximize scholarship and grant opportunities. Scholarships and grants are essentially free money that does not need to be repaid, making them a great way to reduce the amount of student loans needed. Here are some tips on how to maximize scholarship and grant opportunities:

1. Start Early: It is never too early to start looking for scholarships and grants. Many scholarships have early deadlines, so the sooner you start searching, the better your chances of finding and applying for them. Start researching scholarship opportunities in high school or even earlier to give yourself a head start.

2. Search Locally and Nationally: There are a wide variety of scholarships available, both locally and nationally. Don’t limit your search to just one area – cast a wide net and apply for as many scholarships as possible. Check with your school counselor, community organizations, and online scholarship databases to find opportunities that you may be eligible for.

3. Tailor Your Applications: When applying for scholarships, make sure to tailor your applications to each specific scholarship. Take the time to read and understand the requirements of each scholarship and customize your application to highlight how you meet the criteria. This extra effort can make your application stand out from the rest.

4. Keep Track of Deadlines: It is important to keep track of scholarship deadlines and submit your applications on time. Missing a deadline could mean missing out on valuable funding that could help reduce your student loan debt. Use a calendar or spreadsheet to keep track of deadlines and set reminders to ensure you submit your applications on time.

5. Write Compelling Essays: Many scholarships require an essay as part of the application process. Take the time to craft a compelling and well-written essay that showcases your strengths, experiences, and aspirations. The essay is your chance to make a strong impression on the scholarship committee and increase your chances of being selected for the award.

Originally posted 2025-10-02 17:00:00.