Welcome, student loan borrowers! Are you feeling overwhelmed by the high interest rates on your resident student loans? Refinancing could be the solution you’ve been looking for. By refinancing, you could potentially lower your interest rates and save money in the long run. This guide will walk you through the process of refinancing your resident student loans, helping you take control of your finances and make your repayment journey more manageable.

Understanding Resident Student Loan Refinancing

Resident student loan refinancing is a process that allows individuals who are currently enrolled in a residency program to consolidate and refinance their existing student loans. This can be a beneficial option for residents who are looking to lower their interest rates, reduce their monthly payments, or change the terms of their loans. By refinancing, residents can potentially save money in the long run and better manage their debt.

When it comes to resident student loan refinancing, there are a few key factors to consider. First, residents should assess their current financial situation and determine if refinancing is the right move for them. It’s important to consider factors such as interest rates, repayment terms, and any potential fees associated with refinancing. Residents should also take into account their credit score, as this will impact the terms of their refinanced loans.

Residents should also research different lenders and compare their options before choosing a refinancing option. It’s important to find a lender that offers competitive interest rates and favorable repayment terms. Residents can use online tools and resources to compare lenders and find the best refinancing option for their specific needs.

One potential benefit of resident student loan refinancing is the ability to lower monthly payments. By refinancing at a lower interest rate, residents can reduce their monthly payments and free up more of their income for other expenses. This can be especially helpful for residents who are on a tight budget or facing financial challenges.

Another benefit of resident student loan refinancing is the potential to save money on interest over the life of the loan. By refinancing at a lower interest rate, residents can pay off their loans faster and save on total interest costs. This can result in significant savings over time and help residents achieve their financial goals more quickly.

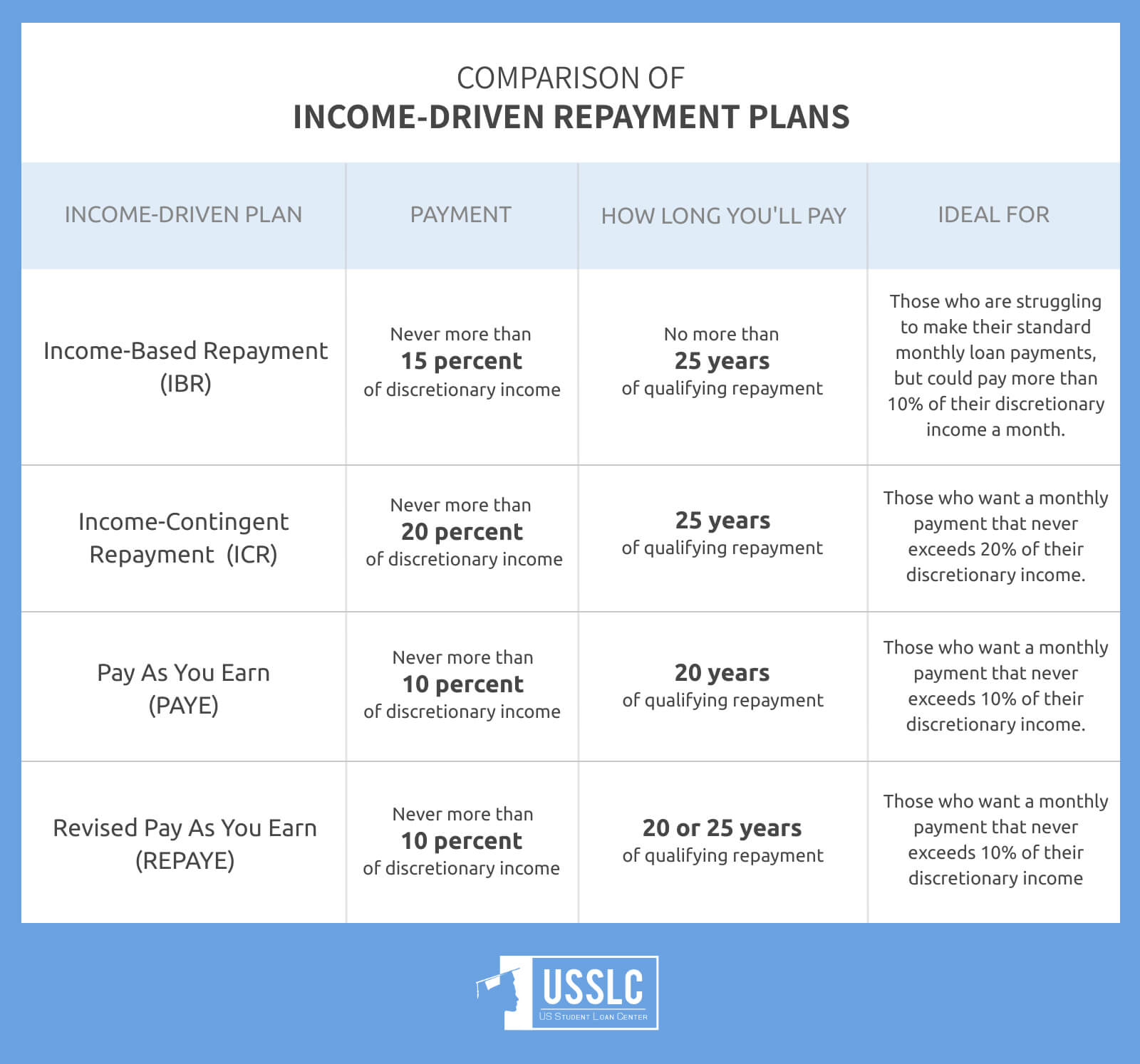

Residents should also be aware of potential drawbacks to refinancing, such as losing access to federal loan benefits. By refinancing private and federal loans together, residents may lose access to benefits such as income-driven repayment plans, loan forgiveness programs, and deferment options. Residents should weigh the pros and cons of refinancing before making a decision.

In conclusion, resident student loan refinancing can be a helpful tool for residents looking to manage their student loan debt more effectively. By understanding the process and taking the time to research their options, residents can make informed decisions about refinancing and potentially save money in the long run. It’s important for residents to weigh the benefits and drawbacks of refinancing before choosing a lender and moving forward with the process.

How to Qualify for Resident Student Loan Refinancing

Resident student loan refinancing is a beneficial option for individuals looking to lower their interest rates and potentially save money on their student loans. However, not everyone may qualify for this type of refinancing. Here are some key factors to consider when determining eligibility for resident student loan refinancing.

1. Employment Status: One of the main requirements for resident student loan refinancing is having a stable job or source of income. Lenders want to ensure that you have the means to repay your refinanced loan, so having a steady job is crucial. As a resident, you may have a limited income, but as long as you have a job that provides a consistent income, you should meet this requirement.

2. Good Credit Score: Another important factor that lenders consider when approving refinancing applications is the applicant’s credit score. A good credit score demonstrates to lenders that you are responsible with managing your finances and are likely to make timely payments on your refinanced loan. Typically, a credit score of 650 or above is considered good, but the higher your score, the better your chances of qualifying for resident student loan refinancing. If your credit score is below this threshold, you may still qualify, but you may be offered less favorable terms.

3. Debt-to-Income Ratio: Lenders also look at your debt-to-income ratio when evaluating your eligibility for resident student loan refinancing. Your debt-to-income ratio is the percentage of your monthly income that goes towards paying off debt. A lower ratio indicates to lenders that you have enough income to cover your expenses, including your refinanced loan payments. Ideally, your debt-to-income ratio should be below 50%, but the lower, the better.

4. Graduating from an Eligible Program: Some lenders may require applicants to have graduated from an eligible program in order to qualify for resident student loan refinancing. Eligible programs are typically those that lead to a degree or certification in a specific field, such as medicine, law, or engineering. If you have completed a program in a qualifying field, you may have a higher chance of being approved for refinancing.

5. Citizenship or Permanent Residency: In order to qualify for resident student loan refinancing, you must be a U.S. citizen or a permanent resident. Lenders may require proof of citizenship or residency status as part of the application process, so make sure you have the necessary documentation before applying for refinancing.

By meeting these key requirements, you can increase your chances of qualifying for resident student loan refinancing and potentially save money on your student loans. Always compare offers from multiple lenders and choose the option that best suits your financial situation.

The Benefits of Refinancing Resident Student Loans

Refinancing resident student loans can offer a multitude of benefits for borrowers. Whether you are a medical resident, dental resident, or any other type of resident, refinancing can help alleviate the financial burden of student loans. Below are some key advantages of refinancing resident student loans:

1. Lower Interest Rates

One of the main benefits of refinancing resident student loans is the potential to secure a lower interest rate. This can result in significant savings over the life of the loan, as lower interest rates mean less money paid in interest. By refinancing at a lower rate, residents can reduce their monthly payments and save money in the long run.

2. Consolidation of Loans

Refinancing resident student loans also allows borrowers to consolidate multiple loans into one. This can streamline the repayment process by simplifying monthly payments and reducing the risk of missing a payment. Consolidating loans can also make it easier to keep track of loan terms and conditions, ultimately making it easier for residents to manage their debt.

3. Flexible Repayment Options

Another benefit of refinancing resident student loans is the opportunity to choose from a variety of repayment options. Many lenders offer flexible terms, such as extended repayment plans, income-driven repayment plans, and variable interest rates. This flexibility allows residents to tailor their repayment plan to their individual financial situation, making it easier to manage monthly payments and avoid defaulting on their loans.

One popular repayment option for residents is an income-driven repayment plan, which caps monthly payments at a percentage of the borrower’s income. This can be particularly helpful for residents who may not have a high salary during their residency but expect to earn more once they complete their training. By choosing an income-driven plan, residents can ensure that their monthly payments are manageable, even on a limited income.

Overall, refinancing resident student loans can provide numerous benefits for borrowers. From lower interest rates to flexible repayment options, refinancing can help residents better manage their debt and save money in the long run. If you are a resident struggling with student loan payments, consider refinancing as a potential solution to your financial challenges.

Top Lenders for Resident Student Loan Refinancing

When it comes to refinancing your resident student loans, there are several top lenders that cater to the unique needs of medical residents and fellows. These lenders offer competitive rates, flexible repayment options, and excellent customer service to help you manage and pay off your loans. Here are some of the top lenders for resident student loan refinancing:

1. SoFi: SoFi is a popular choice for resident student loan refinancing because of their low interest rates and excellent customer service. They offer flexible repayment options, including income-driven repayment plans and deferment options for medical residents who are still in training. SoFi also offers a variety of loan terms to fit your budget and financial goals.

2. Laurel Road: Laurel Road is another top lender for resident student loan refinancing, offering competitive rates and flexible repayment options. They have a special program for medical residents and fellows that allows you to make smaller monthly payments during your training period, then adjust payments based on your income once you start working full-time. Laurel Road also offers a variety of loan terms and repayment plans to suit your needs.

3. CommonBond: CommonBond is a well-known lender that offers resident student loan refinancing with competitive rates and flexible repayment options. They have a program specifically designed for medical residents and fellows that allows you to make interest-only payments during your training period, then transition to full payments once you start working. CommonBond also offers a variety of loan terms and repayment plans to help you save money and pay off your loans faster.

4. Earnest: Earnest is a top lender for resident student loan refinancing that stands out for their personalized approach to lending. They take into account your unique financial situation, including your income and expenses, to offer you a customized loan solution that fits your needs. Earnest also offers flexible repayment options and a variety of loan terms to help you save money and pay off your loans faster. Their easy online application process makes it quick and convenient to refinance your resident student loans with Earnest.

In conclusion, there are several top lenders for resident student loan refinancing that cater to the unique needs of medical residents and fellows. These lenders offer competitive rates, flexible repayment options, and excellent customer service to help you manage and pay off your loans. Consider checking out SoFi, Laurel Road, CommonBond, or Earnest for your resident student loan refinancing needs.

Tips for Comparing Resident Student Loan Refinancing Options

Resident student loan refinancing can be a great way to save money on your loans while you are still in residency. However, with so many options available, it can be overwhelming to choose the right one for you. Here are some tips for comparing resident student loan refinancing options:

1. Know Your Current Loan Terms: Before you start comparing refinancing options, make sure you fully understand the terms of your current loans. This includes the interest rates, repayment terms, and any other important details. Knowing this information will help you better assess the potential benefits of refinancing.

2. Compare Interest Rates: One of the main factors to consider when comparing refinancing options is the interest rate. Lowering your interest rate can save you money in the long run, so be sure to compare rates from different lenders to find the best deal. Keep in mind that interest rates can vary based on your credit score and other factors, so it’s important to shop around.

3. Consider Repayment Options: When comparing refinancing options, also consider the repayment options offered by each lender. Some lenders may offer flexible repayment plans, such as income-driven repayment or deferment options. Make sure to choose a lender that offers repayment terms that work best for your financial situation.

4. Look at Fees: In addition to interest rates, it’s important to consider any fees associated with refinancing. Some lenders may charge origination fees or prepayment penalties, which can add to the overall cost of refinancing. Be sure to factor in these fees when comparing options to get a true picture of the potential savings.

5. Read Reviews and Get Recommendations: One of the best ways to compare resident student loan refinancing options is to read reviews from other borrowers. Websites like NerdWallet and Student Loan Hero offer comprehensive reviews of different lenders, providing insights into their customer service, loan terms, and overall satisfaction. Additionally, you can ask for recommendations from friends, family, or colleagues who have refinanced their student loans.

By following these tips, you can make an informed decision when comparing resident student loan refinancing options. Remember to take your time, compare multiple lenders, and choose the option that best fits your financial needs and goals. With the right refinancing choice, you can save money and streamline your loan repayment process during residency.

Originally posted 2025-10-03 06:00:00.